General article

Published in Edition 16

Credit Insurance, full speed ahead

Trade credit insurance (TCI), or credit insurance, refers to a risk management tool that covers the payment risk involved with the purchase and delivery of goods or services. It is purchased to safeguard or overcome the financial losses in case of unforeseen insolvency, bankruptcy, or protracted default in payment. It protects manufacturers, traders, and service providers against losses from non-payment of a commercial trade debt.

The global trade credit insurance market

Size of the global trade credit insurance market

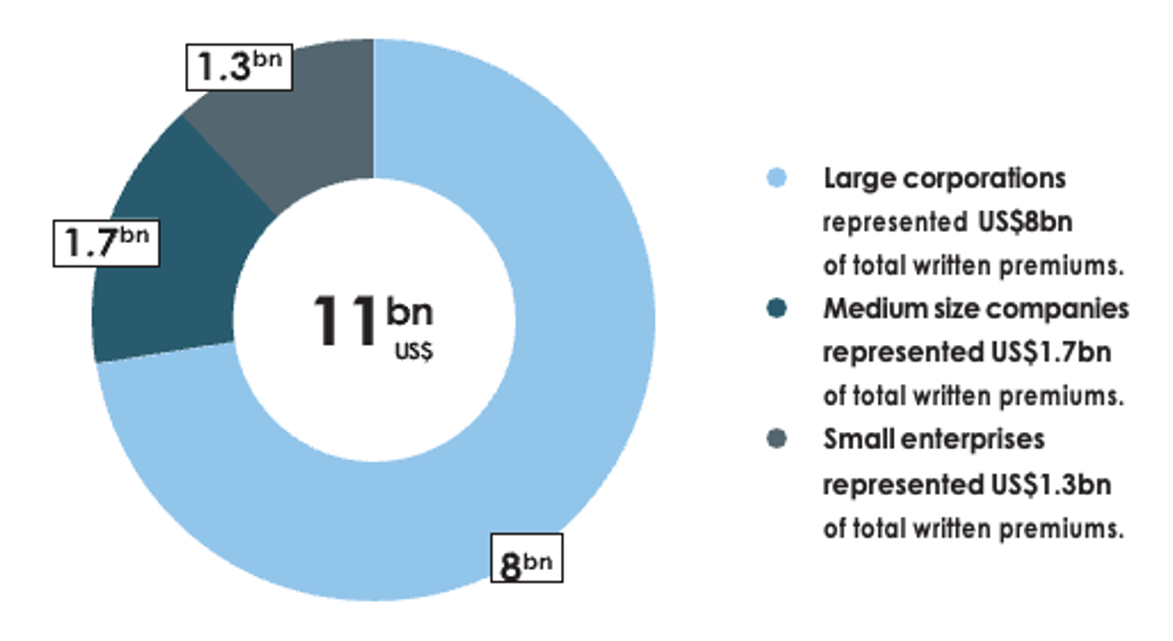

The global trade credit insurance market in 2021 generated approximately US$11bn in gross written premiums. The global market has grown on average 8% a year, over the last 10 years. The forecast is for the trade credit insurance to continue to grow between 8% and 13% annually over the next 10 years and could reach the US$20bn mark by 2030.

The trade credit insurance market has all the right ingredients to grow globally over the next 10 years due to geopolitical and economic uncertainties. Global trade will continue to grow in a more volatile scenario, which will incentivize the purchase of more trade credit insurance, rather than less.

Benefits of trade credit insurance

The principal benefits of credit insurance are:

a) Cash flow protection against risks of nonpayment of invoices by clients. Clients will demand that suppliers continue to extend credit payment terms due to a very competitive market environment. Credit insurance guarantees that suppliers will receive payment for goods or services delivered, as per the policy terms and conditions;

b) Credit insurance permits companies to reduce provisions for bad debt on their balance sheet;

c) Improves credit risk management and is considered a good corporate governance initiative by stakeholders, financial institutions and auditors;

d) Many credit insurers provide very important additional credit services in addition to underwriting the credit risks. These credit services are:

- Advise on the appropriate credit limits for each debtor - client.

- Monitor the debtors 24/7, and advise insured, in a timely fashion, should the debtor begin to delay or stop payments to other suppliers.

- Handle the extra-judicial and judicial collection services for the insured.

- The credit insurer is a valuable additional source of credit information. Most companies rely exclusively on credit bureaus.

- The banks and financial institutions are reacting positively to credit insurance coverage as an excellent form of collateral on receivable discounting structures. This, consequently, reduces the interest rate offered by the financial institution.

Trade credit insurance market in numbers

In 2021 the global trade credit insurance market generated approximately US$11bn in annual written premiums. These annual premiums can be subdivided as follows:

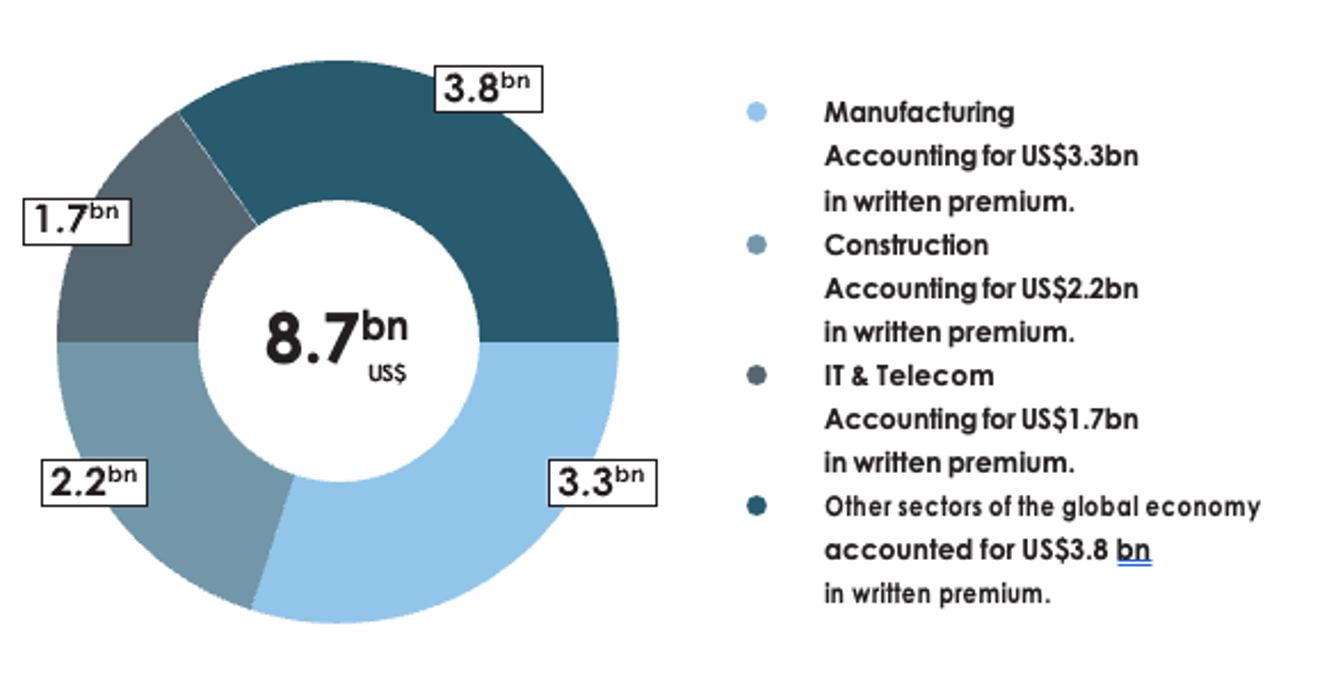

Other related statistics show that the global domestic trade credit insurance market represented US$8.7bn in 2021, and the export credit insurance market US$2.3bn in written premiums.

The main sectors which purchased trade credit insurance in the global market in 2021 were:

The market expects average growth over the next 10 years to be between 8% and 13% annually. Premiums related to large corporations will grow slower, probably closer to the 8% figure, while growth in the small enterprise segment will be closer to the 13% mark.

The global trade credit insurance market in 2021 generated approximately US$11bn in gross written premiums. The global market has grown on average 8% a year, over the last 10 years. The forecast is for the trade credit insurance to continue to grow between 8% and 13% annually over the next 10 years and could reach the US$20bn mark by 2030.

Opportunities going forward

Trade credit insurance protects small and medium-sized (SME) businesses and suppliers of goods and services from non- payment by their clients. Furthermore, many businesses are looking for new ways to trade to expand their market share and expand their business abroad. Trade credit insurance is also gaining popularity as a way for these businesses to expand sustainably, prompting small business owners to seek financing through trade credit insurance as a safe way to trade. As a result, the rise in the number of SMEs seeking to expand into global commerce and the numerous benefits given by trade credit insurance are driving market growth.

Regional analysis

The global trade credit insurance market’s annual premiums in 2021 can be sub divided into four main geographical regions (see below). The fastest growing region is the Asian - Pacific, followed by North America.

Competitive Players

The principal global trade credit insurers in 2021, in alphabetical order, were:

- AIG

- Allianz Trade

- Atradius

- CESCE

- Chubb

- Coface

- Credendo

- QBE

- SINOSURE

- Zurich

The Brazilian trade credit insurance market

Over the last ten years the Brazilian trade credit insurance market has grown steadily in written premiums from BRL 178.000.000,00 (around $34m) in 2011 to BRL 725.000.000,00 (around $140m) in 2021. This is an average annual compounded growth rate of 13%. During this period, it is important to take into consideration that in 2015 and 2016 the Brazilian economy was in recession. It is also important to recognize that the Brazilian and global recessions are becoming more frequent but shorter in duration than in the recent past.

Trade credit insurance can play an important role in bringing more stability to organizations financials in these volatile macro-economic times.

Trade credit insurance companies

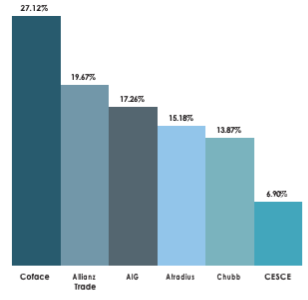

Over the last decade the majority of the major trade credit insurers have entered the Brazilian market creating a national trade credit insurance market. The official 2021 trade credit insurer rankings, by written premium, published by the Brazilian regulator SUSEP shows:

There has also been a rise in the number of specialist trade credit insurance brokers in the Brazilian market over recent years, although the market is mainly serviced by the larger corporate brokers. The brokers union, SINCOR, acknowledges that this line of insurance requires brokers that are both specialist and proactive, and to that end is looking to grow the market by offering its members specific training.

The Brazilian trade credit insurance market mainly consists of large industrial corporate clients from across all sectors of the Brazilian economy. Nevertheless, there is a concentration of risk in a number of sectors including the agro-industry, white and brown goods retailers, iron and steel, pharmaceuticals, textiles, food, and drink.

There has also recently been significant growth in the banking and capital market sectors, as these institutions use credit insurance to enhance financial structures and mitigate credit risks.

There is also good growth potential is in the SME sector.

The Brazilian trade credit insurance market mainly consists of large industrial corporate clients from across all sectors of the Brazilian economy. Nevertheless, there is a concentration of risk in a number of sectors including the agro- industry, white and brown goods retailers, iron and steel, pharmaceuticals, textiles, food, and drink.

Credit insurance is a perfect tool to help evaluate and protect companies from future credit losses and help protect the organizations unknown future credit risks.

Trade credit insurance - loss ratio

The trade credit insurance market has performed very well over the last ten years. The average annual loss ratio has been below 35%, except for 2015 and 2016, where the loss ratio rose to approximately 135% due to the macroeconomic recession.

Types of trade credit insurance in Brazil

The two-principal trade credit insurance products found in Brazil are “Domestic Credit Insurance” and “Export Credit Insurance.” On average, over the last ten years, domestic credit insurance has accounted for about 90% of total written premium, whilst export credit insurance premiums have made up the remaining 10%.

In terms of the main types of coverage, over the last decade, “Traditional Whole Turnover Insurance” accounts for 70% of written premium, while “Excess of Loss Insurance” accounts for the remainder. In recent years there has also been a preference for “Excess of Loss” type programmes, due to the predictability in coverage, with non- cancellable credit limits, amongst the more qualified institutional buyers of credit insurance. That said, the “Risk Management” services offered by the traditional whole turnover credit insurers is a huge benefit for SMEs who have been able to take full advantage of the monitoring and collection services offered by the insurers to help them avoid internal credit and collection costs.

Future growth is expected to come from the purchase of trade credit insurance by organizations looking to mitigate their credit risks and balance sheet provisions in line with the IFRS-9 accounting norms introduced in 2018. Credit insurance is a perfect tool to help evaluate and protect companies from future credit losses and help protect the organizations unknown future credit risks.

-85.jpg)